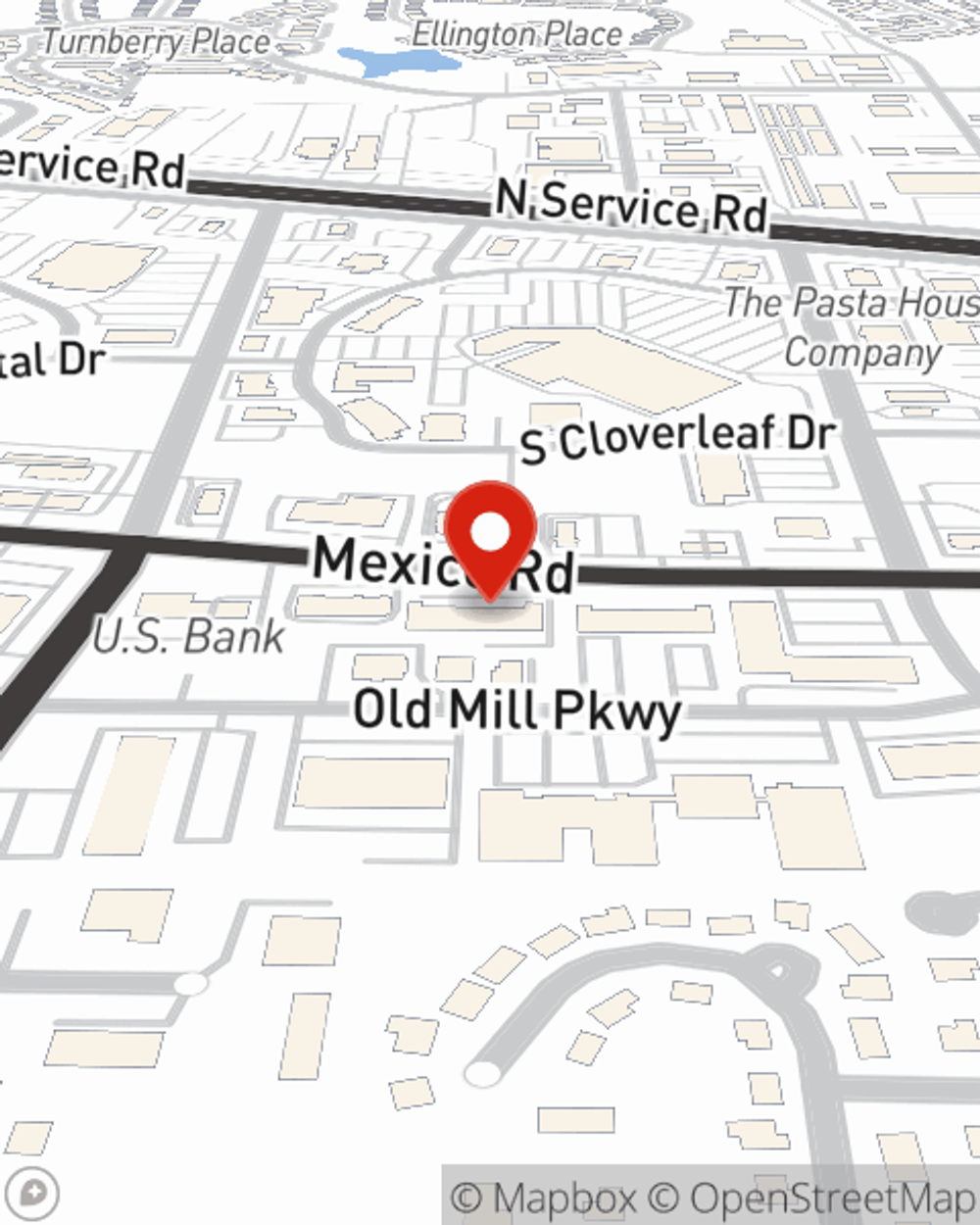

Business Insurance in and around Saint Peters

Calling all small business owners of Saint Peters!

Insure your business, intentionally

- Saint Charles County

- Saint peters

- St. Louis

- O'Fallon

- Florissant

- Cottleville

- Weldon spring

- Lake Saint Louis

- Chesterfield

- Saint Charles

- Maryland Heights

- Wentzville

- Foristell

- St. Paul

- Creve Coeur

- Ballwin

- Wildwood

- Eureka

- Clayton

- Bridgeton

- Overland

- Weldon Spring Height

- St. Louis County

- Jefferson County

Your Search For Fantastic Small Business Insurance Ends Now.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Accidents happen, like a customer stumbles and falls on your property.

Calling all small business owners of Saint Peters!

Insure your business, intentionally

Keep Your Business Secure

With options like extra liability, errors and omissions liability, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Matt Williams is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

Eager to discover the specific options that may be right for you and your small business? Simply call or email State Farm agent Matt Williams today!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Matt Williams

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?